No doubt you’re aware that the general narrative around the state of the economy is pessimistic at best. With rising interest rates, inflation, supply chain issues and a cooling off in the house market, it’s a lot to digest. So, what does it all mean? The simple answer is it depends on who you ask.

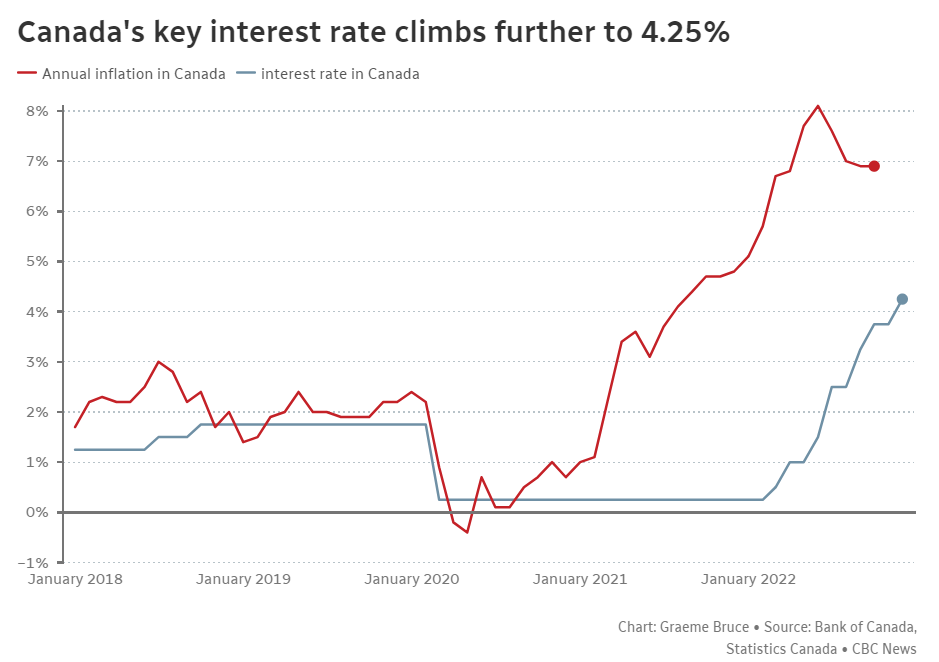

With another 50 basis point hike today, taking the benchmark interest rate to 4.25%, it’s the 7th time the rate has been raised this year. With the other six rate hikes since March, it’s clear that the Fed’s efforts to tame inflation is in full swing. Can we expect an end to the increases? Only time will tell. Some analysts’ forecasts predict a “long and ugly” recession with a world of pain in store. Others take a more moderate stance, with some degree of optimism. Some pundits foresee inflation curbing in the new year, while others say to strap in for a longer haul.

How does one navigate the soup of news when it comes to trying to understand how it will affect us individually? I’m not saying I have a definitive answer, but what I will tell you is that what I do is read a lot of news from different sources. If you stick to one news source, your views may be skewed to one view. While it might seem counter-intuitive to get a variety of information, it’s a way to do your homework and to make sure you get both sides of the argument. At the end of the day, one side is going to be wrong, but it’s in your best interests to understand the matter from all angles.

Predictions are considering such things as the severity of the impending recession, the length of time it will last and how it will affect individuals and businesses. This can be nerve racking when the prediction speaks to how it affects you personally. Questions like, “Should I invest? Should I take on a mortgage? Can I afford my mortgage payment?”, are just a few of the personal scenarios that we face during times of financial unrest.

What does this mean for Columbia Valley real estate? Housing prices have softened since earlier in 2022, but not drastically. I don’t have a crystal ball, but it will be interesting to see where prices and demand go if there is another interest rate hike and there is the customary pick up in the real estate market in the spring. No doubt another rise in interest rates will dampen buyers’ enthusiasm, but if some forecasts are right, we should see some improvement in the medium term after some more pain.

If history has taught us anything, it’s the hope for the best and plan for the worst. In the meantime, get your information from more than one credible source and talk to your financial or investment professional to get their views on how to best weather the economic uncertainty ahead of us.